EXECUTIVE COMPENSATION

Summary Compensation Table

The table below summarizes the total compensation paid or earned during the fiscal years ended December 31, 20162017 and 2017.2018.

| Name, | Stock | Stock | ||||||||||||||||

| Principal | Awards | Option | ||||||||||||||||

| Position | Salary | (1) | Awards | Total | ||||||||||||||

| Chad Hoehne, | 2017 | $ | 269,000 | $ | 0 | $ | 0 | $ | 269,000 | |||||||||

| President | 2016 | $ | 275,008 | $ | 0 | $ | 0 | $ | 275,008 | |||||||||

| Robert | 2017 | 105,000 | 0 | 0 | 105,000 | |||||||||||||

| Siqveland, | 2016 | 103,600 | 0 | 0 | 103,600 | |||||||||||||

| Secretary | ||||||||||||||||||

| Brian Hinchley, | 2017 | 177,000 | 0 | 0 | 177,000 | |||||||||||||

| CEO / CFO | 2016 | 200,000 | 0 | 0 | 200,000 | |||||||||||||

| Name, Principal Position | Salary and Bonus | Stock Awards | Total | |||||||||||

| Chad Hoehne, | 2018 | $ | 337,222 | $ | 0 | $ | 337,222 | |||||||

| President, CTO and CEO(1) | 2017 | 327,298 | 0 | 327,298 | ||||||||||

| Robert Siqveland, COO, | 2018 | 134,478 | 0 | 134,478 | ||||||||||

| Secretary | 2017 | 137,926 | 0 | 137,926 | ||||||||||

| Randy Gilbert, CFO(2) | 2018 | 191,500 | 117,500 | (4) | 257,500 | |||||||||

| Brian Hinchley, CEO /CFO(3) | 2017 | 285,500 | 0 | 177,000 | ||||||||||

| (1) | (1) Chad Hoehne was appointed as the Company’s Chief Executive Officer on November 20, 2017. From November 20, 2017 until January 8, 2018, he also served as the interim Chief Financial Officer. |

| (2) | Mr. Gilbert was appointed as the Company’s Chief Financial Officer on January 8, 2018. |

| (3) | Brian Hinchley resigned as CEO/CFO effective November 16, 2017. |

| (4) | The amounts represent the aggregate grant date fair value with respect to stock options granted in the years indicated. The fair value was calculated in accordance with stock-based accounting rules (ASC 718). For a discussion of the assumptions used in calculating the grant date fair value, see footnote 5 to our financial statement contained in our Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on March 28, 2019. |

We do not currently have any employment or change-in-control agreements with any named executives or any other current members of our executive management. As of the date of this Proxy Statement, we do not offer our executive employees any pension, annuity, profit- sharing or similar benefit plans other than insurance and the company 401K. Executive compensation is subject to change from time to time concurrent with our requirements and policies as established by the Board of Directors and its Compensation Committee.

Outstanding Equity Awards at Fiscal Year End

As of December 31, 2018, our named executives had the following outstanding options to purchase common stock:

| OPTION AWARDS | STOCK AWARDS | |||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Price ($) | Option Expiration Date | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested ($) | ||||||||||||||||||

| Chad Hoehne | — | — | N/A | N/A | — | — | ||||||||||||||||||

| Robert Siqveland | — | — | N/A | N/A | — | — | ||||||||||||||||||

| Randy Gilbert | — | — | N/A | N/A | 50,000 | (1) | $ | 140,500 | ||||||||||||||||

| Brian Hinchley | — | — | N/A | N/A | — | — | ||||||||||||||||||

| (1) | As of December 31, 2018, Randy Gilbert, the Company’s Chief Financial Officer, held 50,000 shares of restricted stock with a market value of $140,500. The transaction and forfeiture restrictions with respect to 20,000 such shares lapsed on January 8, 2019, and such restrictions on the remaining 30,000 shares are schedule to lapse in equal annual installments of 10,000 each on January 8, 2020, 2021 and 2022. |

Director Compensation

The table below summarizes the total cash and non-cash compensation paid or earned during the fiscal year ended December 31, 2018 by each individual who served as a Company director during the fiscal year ended December 31, 2018.

| Name | Fees earned or paid in cash | Stock Awards | Option Awards | Total | ||||||||||||

| Chad Hoehne | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

| William Martinez | 5,000 | 4500 | (2) | 0 | 5,000 | |||||||||||

| Thomas Mertens | 5,500 | 4500 | (2) | 0 | 5,500 | |||||||||||

| Steven Browne(1) | 20,700 | 0 | 0 | 20,700 | ||||||||||||

| Louis Fornetti(1) | 25,200 | 0 | 0 | 25,200 | ||||||||||||

| Gary Loebig(1) | 19,575 | 0 | 0 | 19,575 | ||||||||||||

| (1) | Messrs. Browne, Fornetti and Loebig did not stand for reelection at the Company’s 2018 annual stockholders meeting held October 29, 2018. |

| (2) | The amounts in this column represent the aggregate grant date fair value with respect to stock options granted in the years indicated, including the incremental grant date fair value of stock options repriced during the years indicated, if any. The fair value was calculated in accordance with stock-based accounting rules (ASC 718). |

We do not currently have any employment or change-in-control agreements with any named executives or any other current members of our executive management. As of the date of this Proxy Statement, we do not offer our executive employees any pension, annuity or profit - sharing plans other than insurance and the option to participate in the employee 401(K) plan. Executive compensation is subject to change from time to time concurrent with our requirements and policies as established by the Board of Directors and its Compensation Committee.

Outstanding Equity Awards at Fiscal Year End

The Company had no outstanding equity awards as of December 31, 2017 for any named executives.

Director Compensation

The table below summarizes the total compensation paid or earned during the fiscal year ended December 31, 2017 by each individual who served, or is currently serving, as a Company director during the fiscal year ended December 31, 2017.

| Stock | ||||||||||||||

| Name | Compensation | Awards | Total | |||||||||||

| Chad Hoehne | 2017 | $ | 0 | $ | 0 | $ | 0 | |||||||

| Brian Hinchley | 2017 | 0 | 0 | 0 | ||||||||||

| Steven A. Browne | 2017 | 27,600 | 0 | 27,600 | ||||||||||

| Louis Fornetti | 2017 | 33,600 | 0 | 33,600 | ||||||||||

| Gary Loebig | 2017 | 26,100 | 0 | 26,100 | ||||||||||

CORPORATE GOVERNANCE MATTERS

Board of Directors and Independence

The Board of Directors has a standing Compensation Committee and Audit Committee, each of which composed of Messrs. Mertens, Martinez and Hoehne (with Mr. Mertens serving as chairperson). The Company also has a Compliance Committee. The Compensation Committee, which is composed of Messrs. Browne, Fornetti and Loebig (with Mr. Loebig serving as chairperson). The Audit Committee is composed of Messrs. Browne, Fornetti and Loebig (with Mr. Fornetti serving as chairperson). The Compliance Committee is made up of Messrs. Loebig,Martinez, Randy Sayre (our external compliance consultant) and Chad Hoehne (with Mr. LoebigMartinez serving as chairperson). Mr. Siqveland is the Compliance Officer for the Company. Each of the foregoing committees has a written charter, a copy of each of which is available at our website atwww.tabletrac.com. The composition of our Audit Committee and Compensation Committee complies with the listing requirements of The NASDAQ Marketplace Rules. The Compliance Committee complies with the rules of the Nevada Gaming Control Board.

The Board of Directors has determined that Messrs. Browne, FornettiMartinez and LoebigMertens are each “independent,” as such term is defined in Section 5605(a)(2) of the Nasdaq Marketplace Rules, and meet the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934.1934, as amended.

Board Leadership Structure and Risk Oversight

Our Board of Directors is led by a Chairman of the Board, who is an independent director, althoughChad Hoehne, and all of our directors (including our independent directors) participate in board leadership. Presently, Mr. Browne serves as our Chairman of the Board. Because a majority of our directors are independent and all of the members of our board participate in leadership, we believe the leadership structure of our Board of DirectorsDirector allows it to maintain oversight of our management and to carry out its roles and responsibilities onof behalf of the stockholders.

Management and our Board of Directors discuss risks primarily in our board meetings. These discussions generally identify risks that are prioritized and assigned to the appropriate board committee or the full Board for oversight. Our entire Board of Directors periodically discusses our management or risks. Additional review or reporting on Company risks is conducted as needed or as requested by management, the Board of Directors, a board committee, or any single director.

Board and Committee Meetings

The Board of Directors held threefour formal meetings during fiscal 2017 and took action by written consent in lieu of a meeting on one occasion.2018. During fiscal 2017,2018, the Audit Committee held four formal meetings, and the Compensation Committee and Compliance Committee each held two formal meetings.meetings while the Compliance Committee met four times. The Board of Directors attended 100% of the board meetings and meetings of committees to which they belong. Although we have no formal policy regarding directors’ attendance at our annual stockholder meetings, we encourage our directors to attend those meetings. All of our directors serving on the Board of Directors at the time of our 2017 annual meeting of stockholders attended that meeting.

Audit Committee Financial Expert and Related Matters

The Board of Directors has determined that at least one member of the Audit Committee, Mr. Lou Fornetti,Tom Mertens, is an “audit committee financial expert” as that term is defined in Regulation S-K promulgated under the Securities Exchange Act of 1934.1934, as amended. Mr. FornettiMertens qualifies as an “independent director,” as such term is defined in Section 5605(a)(2) of the NASDAQ Listing Rules, and meets the criteria for independence set forth in Rule 10A -3(b)10A-3(b)(1) under the Securities Exchange Act of 1934. The Board of Directors has determined each member of the Audit Committee is able to read and understand fundamental financial statements and that at least one member of the Audit Committee has past experience in finance or accounting matters.

Audit Committee Report

The Audit Committee is responsible primarily for providing oversight and monitoring the preparation and review of our financial statements, which are provided to stockholders and the general public in the disclosures we file with the SEC. In addition, the Audit Committee is responsible for appointing, and reviewing the services of our independent registered public accounting firm.

The Audit Committee does not prepare our financial statements, or determine whether our financial statements are complete and accurate. Rather, our management is responsible for preparing our financial statements. Our independent registered public accountants are responsible for auditing our financial statements to ensure their completeness and accuracy.

The Audit Committee also oversees our accounting policies and the internal controls over financial reporting, which our management is responsible for establishing and maintaining and our independent registered accountants are responsible for reviewing to determine effectiveness.

In fulfilling its oversight over our independent registered public accounting firm, the Audit Committee carefully reviews the engagement of the independent registered public accounting firm, which includes, among other things, the scope of the audit; fees; the assigned partner(s) and other personnel and their industry experience; auditor independence; peer and Public Company Accounting Oversight Board (PCAOB) reviews; significant legal proceedings; previous experience with the firm’s performance; and any non-audit services performed by our independent registered public accounting firm. The Audit Committee meets independently with management, independently with Boulay, and also in executive session with only the Committee members present.

The Audit Committee has reviewed and discussed the audit and the audited financial statements for the year ended December 31, 20172018 with management and Boulay, including a discussion related to the accounting principles used that are unique to this industry. The Audit Committee alsohas discussed with Boulay the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1 AU section 308, as adopted by the PCAOB. The Audit Committee has received and reviewed the written disclosures and the letter from Boulay required by the applicable requirements of the PCAOB regarding Boulay’s communications with the Audit Committee concerning independence, and has discussed with Boulay its independence. The Audit Committee also discussed with Boulay the matters required to be discussed by Auditing Standard No. 16, “Communications with Audit Committees” issued by the PCAOB. The Audit Committee meets independently with management, independently with Boulay, and also in executive session with only the Committee members present.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the financial statements referred to above be included in our Annual Report on Form 10-K for the year ended December 31, 2017.2018.

AUDIT COMMITTEE:

| AUDIT COMMITTEE: | |

| Thomas Mertens (Chair) | |

| William Martinez | |

| Chad Hoehne |

Steven A. Browne

Louis Fornetti (Chair)

Gary Loebig

Compensation Committee

Our Compensation Committee is charged with oversight responsibility for the adequacy and effectiveness of our executive compensation and benefit plans, and is primarily responsible for all matters relating to compensation of our executive officers and the directors, the adoption of all employee compensation and employee benefit plans and the administration of such plans including granting stock incentives or other benefits, and the review and approval of disclosures regarding executive compensation included in this Proxy Statement. Our Compensation Committee has the authority to obtain advice and assistance from external legal, accounting or other advisors, and has the authority to retain, terminate and approve the fees payable to any external compensation consultant to assist in the evaluation of director, and senior executive compensation. Nevertheless, any services to be rendered by our independent accounting firm must be pre-approved by the Audit Committee under our policy regarding the pre-approval of such services.

Nomination of Directors

The Company does not have a standing nominating committee (or other committee performing similar functions). Based on the size of our Board of Directors, we believe it is appropriate for all of our directors to be involved in the identification and consideration of director nominees. The Company does not employ any charter or other form of official written policy or guidelines for the purposes of considering director-nominees. Nevertheless, when considering director -nominees,director-nominees, the Company recruits and considers candidates without regard to race, color, religion, sex, ancestry, national origin or disability. Generally, the Company will consider each candidate’s business and industry experience, his or her ability to act on behalf of stockholders, overall board diversity, potential concerns regarding independence or conflicts of interest and other factors relevant in evaluating director-nominees. Typically, the candidates will meet with all members of the management team. Management will also consider a candidate’s personal attributes, including without limitation personal integrity, loyalty to the Company and concern for its success and welfare, willingness to apply sound and independent business judgment, awareness of a director’s vital role in the Company’s good corporate citizenship and image, time available for meetings and consultation on Company matters, and willingness to assume broad fiduciary responsibility.

Our stockholders may recommend to the Board of Directors candidates to be considered for election at the Company’s annual stockholders meeting. In order to make such a recommendation, a stockholder generally must submit the recommendation in writing to the Board of Directors, in care of the Company’s Secretary, at the address of the Company’s headquarters address at least 120 days prior to the mailing date of the previous year’s annual meeting proxy statement.

Code of Ethics

The Company has adopted a Code of Ethics that governs the conduct of our officers, directors and employees in order to promote honesty, integrity, loyalty and the accuracy of our financial statements.

Related-Party Transaction Policy

In all cases, the Company abides by applicable state corporate law when approving all transactions, including transactions involving officers, directors or affiliates. More particularly, the Company’s policy is to have any related-party transactions (i.e.(i.e., transactions involving a director, an officer or an affiliate of the Company) be approved solely by a majority of the disinterested and independent directors serving on the Board of Directors.

Stockholder Communications with Directors

Our Board of Directors has established a means for stockholders and others to communicate with the Board of Directors. If a stockholder has a concern regarding our financial statements, accounting practices or internal controls, governance practices, business ethics or corporate conduct, the concern should be submitted in writing to Mr. Chad Hoehne, CEO, in care of our Secretary at the address of the Company’s headquarters.listed above. If a stockholder is unsure as to which category the concern relates, the stockholder may communicate it to any independent director in care of our Secretary at the address of the Company’s headquarters.listed above. All such stockholder communications will be forwarded to the applicable director(s).

Compliance Committee

Although the CompanyTable Trac has always had a Compliance Officer, with our Nevada licensure, this element has grown increasinglybecome geometrically more important and demanding. We not only have a Compliance Committee, but we have a Nevada consultant on the Compliance Committeecommittee who was a previous member of the Nevada Gaming Control Board (NGCB). The three-person Compliance Committee consists of an outside Board member, Chad Hoehne, CEO, and our external consultant. In addition, the company’s Compliance Officer (Bob Siqveland), with 40 years’ experience in this capacity, provides a report to the Compliance Committeecommittee every quarter at Compliance Committeecommittee meetings. The Compliance Officer then sends the required quarterly and annual reports to various department heads in the Nevada oversight structure to include the NGCB.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our common stock as of September 7, 2018,9, 2019, by (i) each person known by the Company to be the beneficial owner of more than five percent of our outstanding common stock, (ii) each current director, (iii) each executive officer of the Company and other persons identified as a named executive in the Summary Compensation Table, and (iv) all current executive officers and directors, as well as previous directors, as a group. Percentage ownership is based on 4,528,668 shares of our common stock outstanding on the record date.

Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power with respect to the shares set forth opposite his, her or itsname. Unless otherwise indicated, the address of each of the following persons is 6101 Baker Road, Suite 206, Minnetonka, Minnesota 55345.

| Common Shares | Percentage of | |||||||

| Beneficially | Common | |||||||

| Name and Address | Owned(1) | Shares(1) | ||||||

| Chad Hoehne(2) | 1,306,100 | 28.90 | % | |||||

| Robert Siqveland(3) | 206,500 | 4.56 | % | |||||

| Randy Gilbert(4) | 25,225 | * | ||||||

| Steve A. Browne(5) | 84,000 | 1.86 | % | |||||

| Louis Fornetti(6) | 24,000 | * | ||||||

| Gary Loebig(7) | 15,671 | * | ||||||

| All directors and officers as a group(8) | 1,661,496 | 36.8 | % | |||||

| Zeff Capital, LP(9) | 446,863 | 9.89 | % | |||||

1601 Broadway, 12th floor

New York, NY 10019

| Name and Address | Common Shares Beneficially Owned(1) | Percentage of Common Shares(1) | ||||||

| Chad Hoehne(2) | 1,171,600 | 25.87 | % | |||||

| Randy Gilbert(3) | 25,225 | * | ||||||

| Robert Siqveland(4) | 206,500 | 4.56 | % | |||||

| William Martinez(5) | 2,000 | * | ||||||

| Thomas Mertens(6) | 2,000 | * | ||||||

| All directors and officers as a group(7) | 1,407,325 | 31.08 | % | |||||

| Brian Hinchley(8) | 35,000 | * | ||||||

| Zeff Capital, LP(9) | 446,863 | 9.87 | % | |||||

| 1601 Broadway, 12th floor | ||||||||

| New York, NY 10019 | ||||||||

| * | denotes less than one percent. |

* denotes less than one percent.

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC, and includes general voting power and/or investment power with respect to securities. Under the applicable SEC rules, each person’s beneficial ownership is calculated by dividing the total number of shares with respect to which they possess beneficial ownership by the total number of outstanding shares of the Company. In any case where an individual has beneficial ownership over securities that are not outstanding, but that are issuable upon the exercise of options or warrants or similar rights within the next 60 days, that same number of shares is added to the denominator in the calculation described above. Because the calculation of each person’s beneficial ownership set forth in the “Percentage of Common Shares” column of the table may include shares that are not presently outstanding, the sum total of the percentages set forth in such column may exceed 100%. |

| (2) | Mr. Hoehne is the President and a director of the Company. |

| (3) | Mr. Gilbert is the Company’s Chief Financial Officer. |

| (4) | Mr. Siqveland is the Company’s |

| (5) | Mr. |

| (6) | Mr. |

| (7) | Consists of five persons: Messrs. Hoehne, Gilbert, Siqveland, Martinez and Mertens. |

| (8) | Mr. |

| (9) | Share figures reflected in the table are based on a |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors and persons considered to be beneficial owners of more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the SECSecurities and Exchange Commission and NASDAQ. Officers, directors and greater-than-ten-percent shareholdersgreater- than-ten-percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such forms furnished to the Company by its officers and directors, or the Company’s actual knowledge of transactions involving such officers and directors, the Company believes that all such filings were filed on a timely basis for fiscal year 2017.2018.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Proposal Two)

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), our stockholders are entitled to vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the rules of the SEC. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

The compensation of our named executive officers is disclosed in the section entitled “Executive Compensation” above and in the compensation tables and related narrative disclosures.

The Company has designed its executive compensation program to attract, motivate, reward and retain the senior management talent required to achieve our corporate objectives and to increase long-term stockholder value.

This proposal, commonly known as a “say-on-pay” proposal, gives you as a stockholder the opportunity to vote on the compensation of our executive officers through the following resolution:

“RESOLVED, that the stockholders of Table Trac, Inc., approve the compensation of its executive officers as described in the Proxy Statement for its 2019 Annual Meeting.”

Under the Dodd-Frank Act, your vote on this matter is advisory and will therefore not be binding upon the Board of Directors. However, the Compensation Committee of the Board of Directors will take the outcome of the vote into account when determining further executive compensation arrangements.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE FOR APPROVAL OF THE EXECUTIVE COMPENSATION DISCLOSED IN THIS PROXY STATEMENT.

ADVISORY VOTE ON FREQUENCY OF FUTURE “SAY-ON-PAY” ADVISORY VOTES

(Proposal Three)

The Dodd-Frank Act also enables our stockholders to indicate (on an advisory basis) how frequently we should seek an advisory vote on the compensation of our named executive officers, as disclosed pursuant to the SEC’s compensation disclosure rules, such as Proposal Two. In particular, we are asking whether this “say-on-pay” vote should occur every three years, every two years, or every one year.

While the Board of Directors intends to carefully consider the stockholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature.

At the Company’s 2013 Annual Meeting of Stockholders, the stockholders approved frequency of say-on-pay vote of once every three years, and we have been conducted “say-on- pay” advisory votes in accordance with such schedule. The Board of Directors believes that a three-year vote cycle will balance the interest of stockholders in providing regular input on executive compensation and the interests of the Board of Directors and stockholders in allowing sufficient time to evaluate the long-term effectiveness of the Company’s executive compensation philosophy, policies and practices.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE TO HOLD AN ADVISORY VOTE ON THE OVERALL COMPENSATION OF THE COMPANY’S EXECUTIVE OFFICERS EVERY THREE YEARS.

RATIFICATION OF THE APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(Proposal Two)Four)

Our Board of Directors is committed to the quality, integrity and transparency of the Company’s financial reports. Independent auditors play an important part in our system of financial control. Our Board of Directors and its Audit Committee has appointed Boulay P.L.L.P. (“Boulay”) as our independent registered public accounting firm for the fiscal year ending December 31, 2018.2019. A representative of Boulay is expected to attend the Annual Meeting and will be available to make statements and respond to questions from stockholders.

If the stockholders do not ratify the appointment of Boulay, the Board of Directors and Audit Committee may reconsider its selection, but is not required to do so. Notwithstanding the proposed ratification of the appointment of Boulay by the stockholders, the Board of Directors and Audit Committee may, in their discretion, direct the appointment of a new independent registered public accounting firm at any time during the year without notice to, or the consent of, the stockholders, if the Board of Directors or Audit Committee determines that such a change would be in the best interests of the Company.

Fees Billed to Company by Independent Registered Public Accounting Firm

The following table details the fees billed to the Company by Boulay in 20172018 and 2016.2017:

| 2017 | 2016 | |||||||

| Audit Fees(1) | $ | 92,500 | $ | 75,200 | ||||

| Tax Fees(2) | 8,750 | 6,000 | ||||||

| Audit-Related Fees(3) | 19,318 | 44,720 | ||||||

| $ | 120,568 | $ | 125,920 | |||||

| 2018 | 2017 | |||||||

| Audit fees, including quarterly review of Form 10-Q(1) | $ | 105,590 | $ | 92,500 | ||||

| Tax fees(2) | 11,078 | 8,750 | ||||||

| Audit-related fees(3) | 17,010 | 19,318 | ||||||

| All other fees | 0 | 0 | ||||||

| $ | 133,678 | $ | 120,568 | |||||

| (1) | Audit Fees consist of fees for |

| (2) | Tax Fees consist of fees for professional services rendered for tax compliance, tax advice and tax planning. |

| (3) | Audit-Related Fees consist of fees for professional services rendered that |

The Board of Directors has reviewed the services provided by Boulay during the fiscal year ended December 31, 2017,2018, and the amounts billed for such services. After consideration, the Board of Directors has determined that the receipt of these fees by Boulay is compatible with the provision of independent audit services. The Audit Committee has discussed these services and fees with Boulay management to determine that they are appropriate under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as under guidelines of the American Institute of Certified Public Accountants.

Pre-Approval Policy

The Audit Committee is responsible for appointing, setting compensation for and overseeing the work of our independent registered public accounting firm. The Audit Committee has established a policy for pre-approving the services provided by our independent registered public accounting firm in accordance with the auditor-independence rules of the SEC. This policy requires the review and pre-approval by the Audit Committee (or the full Board of Directors) of all audit and permissible non-audit services provided by our independent registered public accounting firm and an annual review of the financial plan for audit fees. During fiscal 2017,2018, 100% of the audit-related and tax services provided by our independent registered public accounting firm were pre-approved by our Audit Committee in conformity with its pre-approval policy.

To ensure that auditor independence is maintained, the Audit Committee annually pre-approvespre- approves the audit services to be provided by our independent registered public accounting firm and the related estimated fees for such services, as well as the nature and extent of specific types of audit-related,audit related, tax and other non-audit services to be provided by our independent registered public accounting firm.

The Board of Directors recommends a vote FOR the ratification of the Company’s independent registered public accounting firm.

STOCKHOLDER PROPOSALS AND

DISCRETIONARY PROXY VOTING AUTHORITY

Any stockholder desiring to submit a proposal for action by the stockholders at the next annual stockholders’ meeting, which will be the 20182020 annual meeting, must submit that proposal in writing to the Secretary of the Company at the Company’s corporate headquarters no later than MayNovember 11, 20182019 to have the proposal included in the Company’s proxy statement for that meeting (unless the date of the Company’s 20182020 annual meeting of stockholders varies more than 30 days from October 29, 2018,23, 2019, in which case a stockholder proposal is due a reasonable amount of time prior to when the Company begins to print and mail its proxy statement for that meeting). Due to the complexity of the respective rights of the stockholders and the Company in this area, any stockholder desiring to propose such an action is advised to consult with his or her legal counsel with respect to such rights. The Company suggests that any such proposal be submitted by certified mail, return-receipt requested.

Rule 14a-4 promulgated under the Securities Exchange Act of 1934 governs the Company’s use of its discretionary proxy voting authority with respect to a stockholder proposal that the stockholder has not sought to include in the Company’s proxy statement. Rule 14a-4 provides that if a proponent of a proposal fails to notify the Company at least 45 days prior to the month and day of mailing of the prior year’s proxy statement, then management proxies will be allowed to use their discretionary voting authority when the proposal is raised at the meeting, without any discussion of the matter.

SOLICITATION

The Company will bear the cost of preparing, assembling and mailing the proxy, Proxy Statement, Annual Report and other materialsmaterial that may be sent to the stockholders in connection with this solicitation. Brokerage houses and other custodians, nominees and fiduciaries may be requested to forward soliciting material to the beneficial owners of stock, in which case they may be reimbursed by the Company for their expenses in doing so. Proxies are being solicited primarily by mail. Nevertheless, officers and employees of the Company may solicit proxies personally, by telephone, by special letter, or via the Internet.

The Board of Directors does not intend to present to the meeting any other matter not referred to above and does not presently know of any matters that may be presented to the meeting by others. If, however, other matters come before the meeting, it is the intent of the persons named in the enclosed proxy to vote the proxy in accordance with their best judgment.

| By Order of the Board of Directors: | |

| ROBERT R. SIQVELAND | |

| Secretary |

[This page intentionally left blank]

[This page intentionally left blank]

BR87336P-0918-NPS

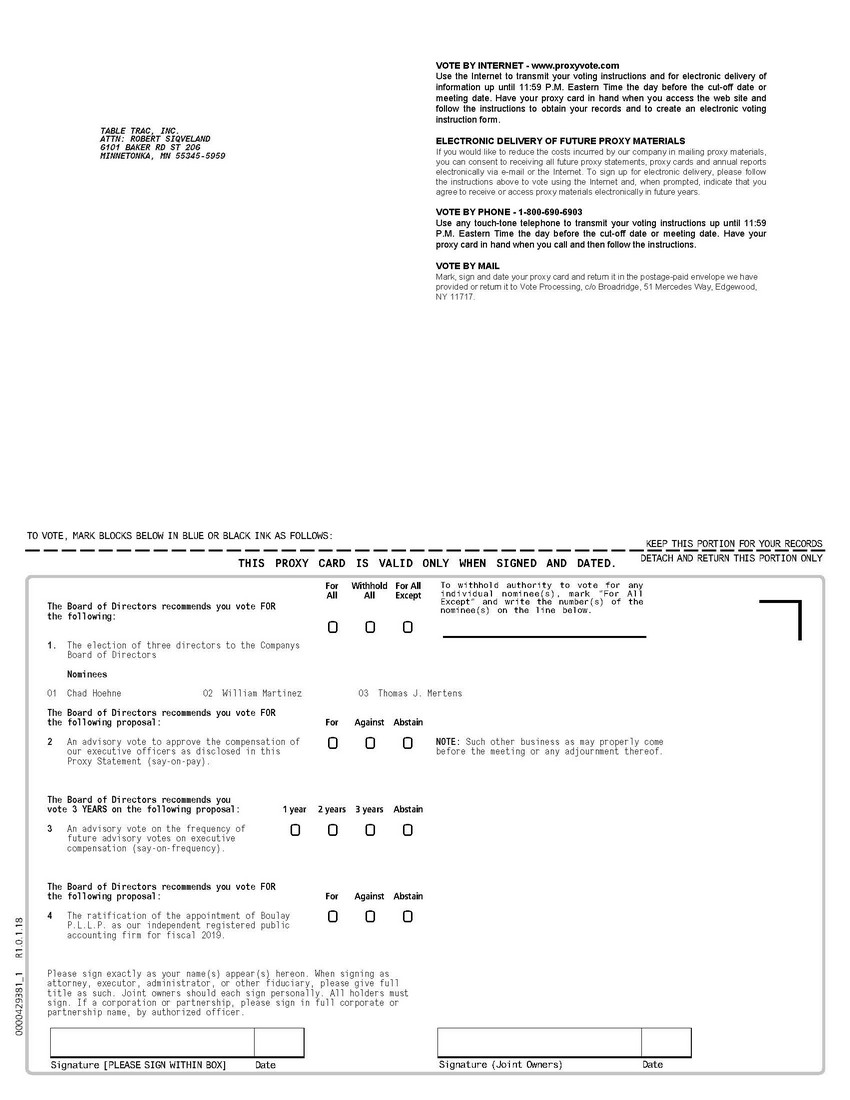

TABLE TRAC, INC. ATTN: ROBERT SIQVELAND 6101 BAKER RD ST 206 MINNETONKA, MN 55345-5959 VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDSDETACH AND RETURN THIS PORTION ONLYTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.ForWithholdFor All To withhold authority to vote for anyAllAllExcept individual nominee(s), mark “For AllThe Board of Directors recommends you vote FOR the following: Except” and write the number(s) of the nominee(s) on the line below.¨¨¨1. Election of Directors Nominees 01 Chad Hoehne 02 Thomas J. Mertens 03 William Martinez ForWithholdFor All To withhold authority to vote for anyAllAllExcept individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below.¨¨¨ 0000386885_1 R1.0.1.17 The Board of Directors recommends you vote FOR the following proposal: 2. To ratify the appointment of Boulay P.L.L.P. as our independent registered public accounting firm for fiscal year 2018. NOTE:Such other business as may properly come before the meeting or any adjournment thereof. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer. For Against Abstain¨¨¨ Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Form 10-K, Proxy Statement are available at www.proxyvote.com TABLE TRAC, INC. Annual Meeting of Shareholders October 29, 2018 10:30 AM This proxy is solicited by the Board of Directors The shareholder(s) hereby appoint(s) Chad Hoehne and Bob Siqveland, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common stock of TABLE TRAC, INC. that the shareholder(s) are entitled to vote at theAnnual Meeting of shareholder(s) to be held at 10:30 AM, CST on 10/29/2018.NOTE: A NEW LOCATION(Crosstown Hwy 62 & Shady Oak Rd.) HILTON GARDEN INN 6330 Point Chase Eden Prairie, MN 55344,and any adjournment or postponement thereof. This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors' recommendations. 0000386885_1 R1.0.1.17Continued and to be signed on reverse side